What Is Accounts Receivable Turnover Ratio and How to Calculate It?

Understanding the financial health of a business is crucial for its success, and one key metric that provides insight into a company's efficiency is the Accounts Receivable Turnover Ratio. It measures how effectively a company collects revenue from its credit sales, shedding light on its credit policies and cash flow management.

A higher turnover ratio generally indicates that a company is efficient at managing its credit. However, it might also indicate that the organization is offering credit too cautiously, reducing its business opportunities and collecting too aggressively, straining customer relationships.

In this blog, we will learn how to calculate the Accounts Receivable Turnover Ratio, its importance, and how to analyze and improve it. It will help you better interpret your business's financial performance and make informed decisions.

What Is Accounts Receivable Turnover Ratio?

The Accounts Receivable Turnover Ratio is a financial metric that assesses how efficiently a company collects its accounts receivable, or the money owed by customers for sales made on credit. It also indicates the number of times a company collects its average accounts receivable balance in a given period, typically a year.

AR Turnover ratio provides insight into the effectiveness of a company’s credit policies and its ability to manage credit sales and collections. Therefore, it gives businesses a better idea of their cash flow and balance sheet health.

A higher turnover ratio indicates that a company is efficient at collecting its receivables and has a shorter collection period, implying better cash flow and potentially fewer bad debts. Conversely, a lower turnover ratio may suggest issues with credit policies, inefficient collection processes, or problems with customer payments, which could lead to cash flow problems.

The Importance of Accounts Receivable Turnover Ratio

AR turnover ratio is a crucial metrics that every business should track to have a better understanding of their credit health. Let’s take a look at the things that make it really important.

1. Cash flow management

A high turnover ratio indicates that a company is collecting receivables quickly, which means more cash flow is available for daily operations, reinvestment, or paying off debts. Efficient cash flow management is crucial for maintaining the liquidity and solvency of the business.

2. Credit policy evaluation

The ratio provides insights into the effectiveness of a company’s credit policies. A high ratio suggests stringent credit policies and efficient collection processes, whereas a low ratio may indicate lenient credit terms or inefficiencies in collecting receivables.

3. Financial health indicator

Consistently high accounts receivable turnover ratios can be a sign of a financially healthy company with reliable customers who pay on time. It reassures investors, creditors, and other stakeholders about the company's credit risk management.

4. Performance benchmarking

Companies can use the accounts receivable turnover ratio to benchmark their performance against industry standards or competitors. This comparison can highlight areas for improvement or validate the effectiveness of current credit management practices.

5. Bad debt reduction

A high turnover ratio reduces the risk of bad debts, as receivables are collected more promptly. Lower bad debt expense translates to better profitability and fewer write-offs on the income statement.

6. Operational efficiency

Efficient collection processes reflected in a high turnover ratio indicate streamlined operations and good customer relationship management. This efficiency can lead to cost savings and improved overall business performance.

7. Decision making

Understanding the accounts receivable turnover ratio helps management make informed decisions regarding extending credit to customers, setting collection policies, and managing working capital.

Formula of Accounts Receivable Turnover Ratio

The Accounts Receivable Turnover Ratio is calculated using the following formula:

Accounts Receivable Turnover Ratio = (Net Credit Sales / Average Accounts Receivable)

Components of the formula

- Net Credit Sales: This represents the total revenue generated from credit sales during a specific period, typically a year, after deducting any returns, allowances, or discounts.

- Average Accounts Receivable: This is the average of the accounts receivable balance at the beginning and the end of the period. It provides a more accurate measure of receivables over the entire period.

Average Accounts Receivable = (Beginning Accounts Receivable + Ending Accounts Receivable) / 2

Steps to Calculate:

- Determine net credit sales: Obtain the total credit sales for the period from the income statement. Ensure to subtract any returns, allowances, or discounts to get the net credit sales.

- Calculate average accounts receivable: Find the accounts receivable balance at the beginning of the period and at the end of the period from the balance sheet. Then, Compute the average by adding the beginning and ending balances and dividing by two.

- Apply the formula: Divide the net credit sales by the average accounts receivable to get the turnover ratio.

Examples of AR turnover Ratio

Suppose a company XYZ has the following financial data for the year:

Net Credit Sales: $750,000

Beginning Accounts Receivable: $70,000

Ending Accounts Receivable: $80,000

Average Accounts Receivable = (Beginning Accounts Receivable + Ending Accounts Receivable) / 2 = ($70,000 + $=80,000) / 2 = $150,000 / 2 = $75,000

Accounts Receivable Turnover Ratio = (New credit sales / Average Accounts Receivable) = ($750,000 / $75,000) = 10

This means the company collects its average accounts receivable 10 times during the year.

How to Interpret Accounts Receivable Turnover Ratio?

In the previous example, we saw that the company XYZ has an Accounts receivable Turnover Ratio of 10. It means that the company collects its average accounts receivable, which was $75,000, ten times in a year. A company can get both a high and low turnover ratio, which indicates different things. Let’s understand the difference between them.

High AR turnover ratio

It indicates that the company has a solid credit validation mechanism in place before offering credit. At the same time, the collections team of the organization is also very efficient in recovering debts.

However, it might also mean that the company operates mostly on a cash basis or is too conservative in offering credit to its customers. This might result in driving away potential customers and reducing the overall revenue potential of the company.

Low AR Turnover Ratio

A low turnover ratio is bad for an organization and shows poor credit policies, inefficient collection process and bad quality customers. It means while the organization is handing out credit pretty easily, it is unable to recover the amount, resulting in increased bad debt and losses.

Companies with a low turnover ratio should evaluate all of their processes and find out the reason behind it. It could be due to lenient credit policies, or poor collection processes.

Should you aim for a high or low AR Turnover Ratio?

Whether a company should aim for a high or low Accounts Receivable (AR) Turnover Ratio depends on various factors, including industry standards, business model, and overall financial strategy. However, in general, aiming for a high AR Turnover Ratio is usually preferable. Here’s why:

- Efficient collections, meaning that customers are paying their invoices quickly.

- Improved cash flow and high liquidity that the business needs to cover its operational expenses and investments.

- Reduced bad debt as customers who pay promptly are less likely to default on their payments.

- Signals to investors, creditors, and stakeholders that the company manages its credit well and maintains a robust cash flow.

- Operational efficiency that can lead to cost savings and better overall financial performance.

But, is a low turnover ratio always a negative thing? Its actually not and here are a few situations when it is acceptable.

- Industry norms: In some industries, longer payment terms are standard practice. For example, in industries where large projects or capital goods are involved, customers may negotiate longer payment periods. In such cases, a lower AR turnover ratio might still be acceptable and not necessarily indicate poor performance.

- Strategic credit terms: Some companies may intentionally offer more lenient credit terms to attract and retain customers or to encourage larger orders. While this may lower the turnover ratio, it could be part of a strategic decision to drive sales growth.

- Building customer relationships: Offering flexible payment terms can strengthen customer relationships and loyalty. For new or key customers, extended credit terms might be part of a strategy to build long-term partnerships, even if it temporarily lowers the AR turnover ratio.

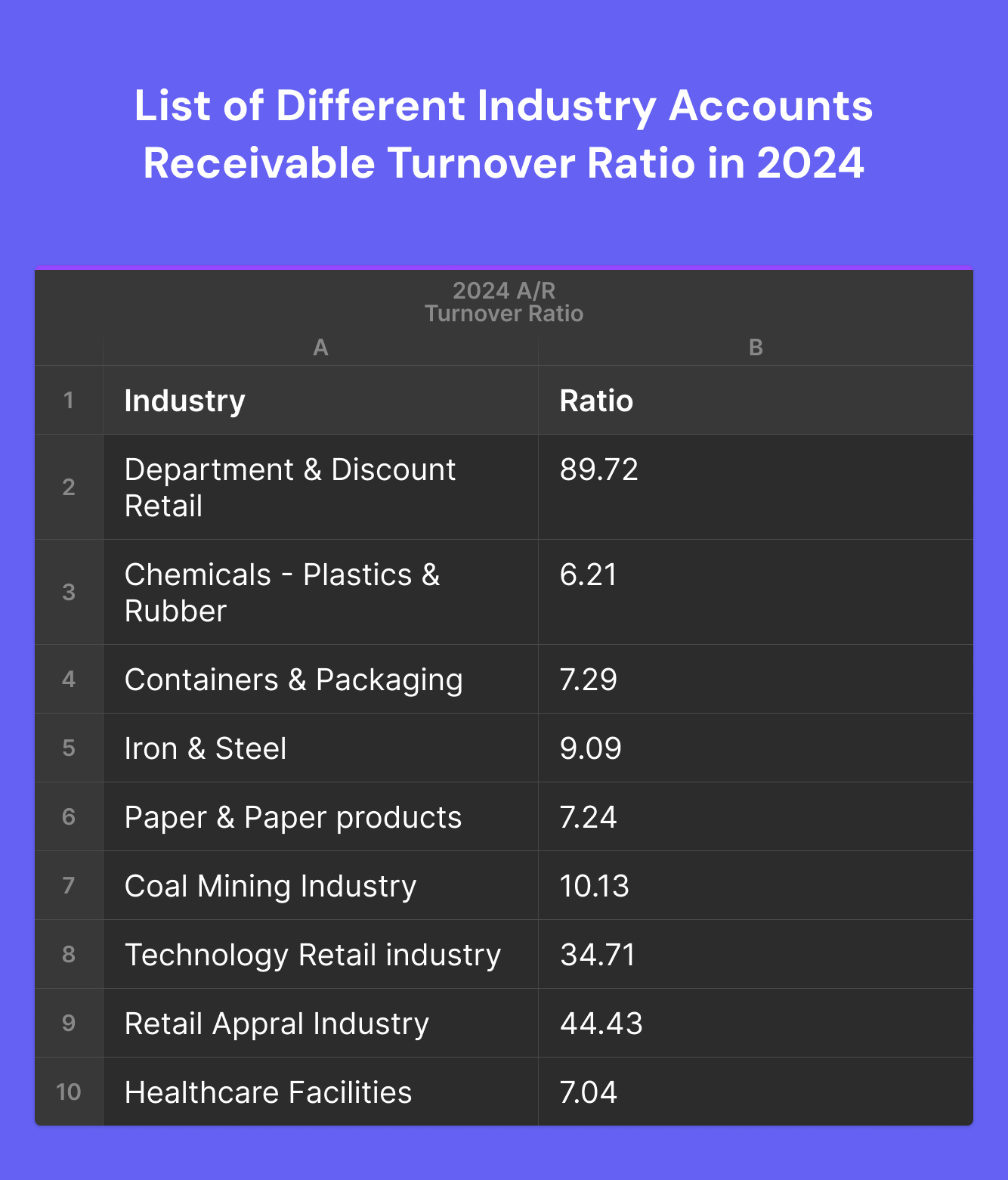

List of Different Industry Accounts Receivable Turnover Ratio in 2024

Here’s a list of of AR Turnover Ratio of top industries in Q2 2024.

Source: CSIMarket

Limitation of Accounts Receivable Turnover Ratio

The Accounts Receivable Turnover Ratio is a useful metric to understand the AR health of a company. However, for every business, it should be interpreted with context. For example, a company in the manufacturing industry is bound to have a lower turnover ratio then retail.

It is also important to note that some companies calculate their turnover ratio using the total sales instead of credit sales. This increases the overall ratio and doesn’t paint a clear picture of the credit policies, collections and balance sheet of the company.

Companies that do not keep track of their opening and closing AR balances of every day or month might also end up calculating the average accounts receivable but using the balances one year apart, which might not always be effective.

So, to make the most of Accounts Receivable Turnover Ratio, it must be calculated alongside other metrics to a get a better understanding of the balance sheet health of an organization.

Other Metrics That Should Be Analyzed Alongside AR Turnover Ratio

Analyzing the Accounts Receivable (AR) Turnover Ratio is important, but to get a comprehensive view of a company's financial health and efficiency, it's essential to consider other related metrics as well. Here are several key metrics that should be analyzed alongside the AR Turnover Ratio:

1. Days Sales Outstanding (DSO)

It measures the average number of days it takes a company to collect payment after a sale has been made on credit. A lower DSO indicates quicker collection, which improves cash flow, while a higher DSO might suggest collection issues or lenient credit terms.

Formula:

DSO = (Average Accounts Receivable / Net Credit Sales ) × Number of Days

Why?

DSO is important because it helps businesses understand how long their cash is tied up in receivables. By efficiently managing DSO, businesses can enhance liquidity and operational efficiency.

2. Bad debt ratio

It measures the proportion of receivables that are not expected to be collected. This ratio helps in assessing the quality of the company’s receivables and the effectiveness of its credit risk management.

Formula:

Bad Debt Ratio = Bad Debts / Net Credit Sales

Why?

A higher bad debt ratio indicates potential issues with the company’s credit policies or customer creditworthiness. It highlights the need for tighter credit controls or more rigorous customer vetting processes.

3. Aging of Accounts Receivable

Aging of Accounts Receivable is an analysis that categorizes receivables based on the length of time an invoice has been outstanding. It helps in identifying overdue accounts and potential collection problems by breaking down receivables into different age categories, such as 30, 60, 90, and 120+ days overdue.

Why?

This analysis provides detailed insights into the health of the receivables portfolio. It helps companies focus their collection efforts on the most overdue accounts, thereby improving overall collection efficiency.

4. Collection Effectiveness Index (CEI)

It measures the effectiveness of the collection process over a given period. It considers both the beginning and ending receivables, along with credit sales and write-offs, to provide a comprehensive view of collection efficiency.

Formula:

CEI=( (Beginning Receivables + Credit Sales - Ending Receivables - Write-offs) / (Beginning Receivables + Credit Sales - Ending Receivables) )×100

Why?

CEI gives a percentage that reflects how effective the company is at collecting its receivables within the payment terms. A higher CEI indicates better collection efficiency and vice versa.

5. Net profit margin

It measures how much profit a company makes for every dollar of revenue after all expenses, including taxes and interest, have been deducted. It is expressed as a percentage and reflects the overall profitability and efficiency of the company.

Formula:

Net Profit Margin = (Net Income / Revenue) × 100

Why?

A higher net profit margin indicates that the company is more efficient at converting sales into actual profit, which can positively impact its ability to manage and collect receivables. It also suggests that the company has better control over its costs and expenses.

How to improve Accounts Receivable Turnover ratio?

Improving the Accounts Receivable (AR) Turnover Ratio involves enhancing the efficiency of collecting outstanding receivables. Here are several strategies to achieve this:

1. Review and tighten credit policies

Conduct thorough credit checks before extending credit to new customers to ensure they have a good payment history and reliable financial stability. You must define clear and concise credit terms that outline payment due dates, interest on late payments, and penalties for overdue accounts.

2. Offer incentives for early payments

Provide discounts to customers who pay their invoices early. For example, a 2% discount for payments made within 10 days can encourage quicker payments. You can also start loyalty programs that reward customers for consistently paying on time. This can foster long-term relationships and prompt payments.

3. Improve invoicing practices

Utilize electronic invoicing systems to speed up the delivery of invoices and make it easier for customers to pay. They are more efficient and less prone to errors.

4. Enhance collection processes

Implement a systematic approach to follow up on overdue accounts. Regular reminders through emails or phone calls can prompt customers to pay on time. You can also implement automated systems to send reminders to customers before the due date and immediately after the due date if payment has not been received.

5. Offer multiple payment options

Provide various payment options, such as credit cards, bank transfers, and online payment platforms, to make it convenient for customers to pay. For larger invoices, consider offering installment payment plans to ease the financial burden on customers and ensure consistent cash flow.

6. Monitor accounts receivable regularly

Regularly review accounts receivable aging reports to identify overdue accounts. This allows you to take timely action on delinquent accounts. Track key performance metrics related to accounts receivable, such as Days Sales Outstanding (DSO) and bad debt ratio, to identify trends and areas for improvement.

7. Customer service

Provide excellent customer service to build strong relationships. Satisfied customers are more likely to pay promptly and maintain good payment practices.

8. Consider factoring or financing options

Sell your accounts receivable to a factoring company to receive immediate cash. This can be particularly useful for businesses facing cash flow challenges. You can also use receivables as collateral to obtain financing from banks or financial institutions. This provides quick access to funds while waiting for customers to pay.

FAQs

What is a good accounts receivable turnover ratio?

A good accounts receivable turnover ratio typically falls between 5 and 10. This means that the company collects its average receivables 5 to 10 times per year, reflecting efficient credit management and effective collection processes. It indicates that the company quickly collects its receivables, improving liquidity, but not too high, that indicates overly strict credit policies that could deter potential customers.

What is a good AR to sales ratio?

A good AR-to-sales ratio generally ranges from 10–15%. This ratio indicates the proportion of a company's sales made on credit compared to total sales. Maintaining this ratio within the 10-15% range suggests effective credit management, balancing sales growth with the risk of uncollected receivables.

How do you calculate the payables turnover ratio?

To calculate the payables turnover ratio, divide the total supplier purchases by the average accounts payable during a specific period. The formula is: (Payables Turnover Ratio = Total Supplier Purchases / Average Accounts Payable). This ratio measures how quickly a company pays off its suppliers.

What is AR AP turnover ratio?

The AR AP turnover ratio compares how quickly a company collects its accounts receivable versus how fast it pays its accounts payable. It is calculated by dividing the accounts receivable turnover ratio by the accounts payable turnover ratio. This comparison helps assess the company's liquidity management and operational efficiency.