Dispute Management: Definition, Types & How to Handle Them

Effective handling of customer disputes is an important aspect for every business. A pro-customer approach helps build trust and credibility while helping maintain a loyal customer base. A survey shows that 84% of business and finance leaders consider customer experience to be important in accounts receivable.

However, dispute management can be tricky and difficult as it takes a lot of time and resources, which can impact a company’s bottom line. So, in this blog, we will explore all there is to know about dispute management, including the biggest challenges that businesses face and top strategies to handle them.

What is Dispute Management?

Dispute management refers to the process of handling conflicts or disagreements that arise between two or more parties, often in business transactions or financial matters. In many cases, disputes occur when there is a discrepancy or misunderstanding related to contracts, payments, or the delivery of goods and services.

Effective dispute management ensures that these conflicts are resolved in a timely and efficient manner to maintain good relationships and avoid legal complications.

In a business or financial context, dispute management is essential to ensure that issues are addressed before they escalate into major problems. This often involves a structured approach that includes investigation, communication with all parties involved, and finding an appropriate resolution, whether through negotiation, mediation, or arbitration.

For example, in debt collection, disputes may arise over billing errors or payment discrepancies, requiring careful attention to documentation and communication.

Successful dispute management can reduce costs, minimize disruption to operations, and protect a company’s reputation. By resolving conflicts effectively, businesses can maintain trust with clients, vendors, and stakeholders, which is essential for long-term success. Moreover, having a clear dispute management policy can help prevent future conflicts by setting expectations and guidelines for addressing potential issues.

Different Types of Disputes

Disputes typically arise due to disagreements between a business and its customers over payments, services, or terms. Here are the key types of disputes:

1. Billing Disputes

Billing disputes occur when a customer claims that the invoice amount is incorrect. This could be due to overcharges, duplicate billing, or incorrect pricing for products or services. Such disputes are common and usually require a thorough review of the invoice and purchase order to resolve discrepancies.

2. Product or Service Disputes

These disputes arise when the customer is dissatisfied with the product or service they received. They may claim that the product was defective, the service was subpar, or the delivery was late or incomplete. In these cases, the customer may withhold payment until the issue is addressed.

3. Payment Terms Disputes

Customers may dispute the terms of payment if there is confusion or disagreement over when payment is due, discounts offered for early payment, or interest charged on late payments. These disputes often result from unclear contract terms or miscommunication during the negotiation process.

4. Unauthorized Charges

Customers may dispute charges that they claim were unauthorized or unexpected. This could include charges for additional services, fees, or penalties that were not clearly communicated upfront. Resolving these disputes often involves verifying the customer's consent or revisiting the contract.

5. Quality or Quantity Disputes

A customer might claim that the goods or services delivered were either of insufficient quality or not in the quantity ordered. This type of dispute requires reviewing order confirmations, delivery receipts, and any communication related to the sale to verify the validity of the claim.

The Biggest Challenges In Dispute Management

Dispute management is a critical aspect of collections and accounts receivable, as unresolved disputes can lead to delayed payments, strained relationships, and increased operational costs. Managing these disputes effectively requires a systematic approach, but there are several challenges that businesses often face. These challenges can complicate the resolution process, making it difficult to maintain healthy cash flow and client relationships.

- Lack of Clear Documentation: One of the biggest challenges in dispute management is insufficient or unclear documentation. Without accurate records of transactions, contracts, and communications, it becomes difficult to resolve disputes promptly. Missing or incomplete documentation can lead to extended negotiation periods and legal complications.

- Inefficient Communication: Poor communication between the customer and the business, or within internal departments, can further delay dispute resolution. Miscommunication or lack of responsiveness from either party can escalate minor issues into larger disputes. Coordinating effectively across different teams, such as sales, billing, and legal, is often a significant hurdle.

- Delays in Response: Delays in responding to disputes can worsen the situation. Whether it's the customer delaying their complaint or the company taking too long to address the issue, slow responses increase the likelihood of unresolved disputes leading to customer dissatisfaction or legal action.

- Complex Dispute Cases: Some disputes are particularly complex, involving multiple issues such as billing errors, contract disagreements, or delivery failures. These cases often require time-consuming investigations and cross-departmental coordination, which can slow down resolution and increase the risk of cash flow disruption.

- High Costs of Resolution: Resolving disputes often incurs costs related to legal fees, labor, and lost time. For businesses with frequent disputes, these costs can accumulate and impact profitability. In some cases, the expense of resolving the dispute might outweigh the amount in question, making it challenging to prioritize.

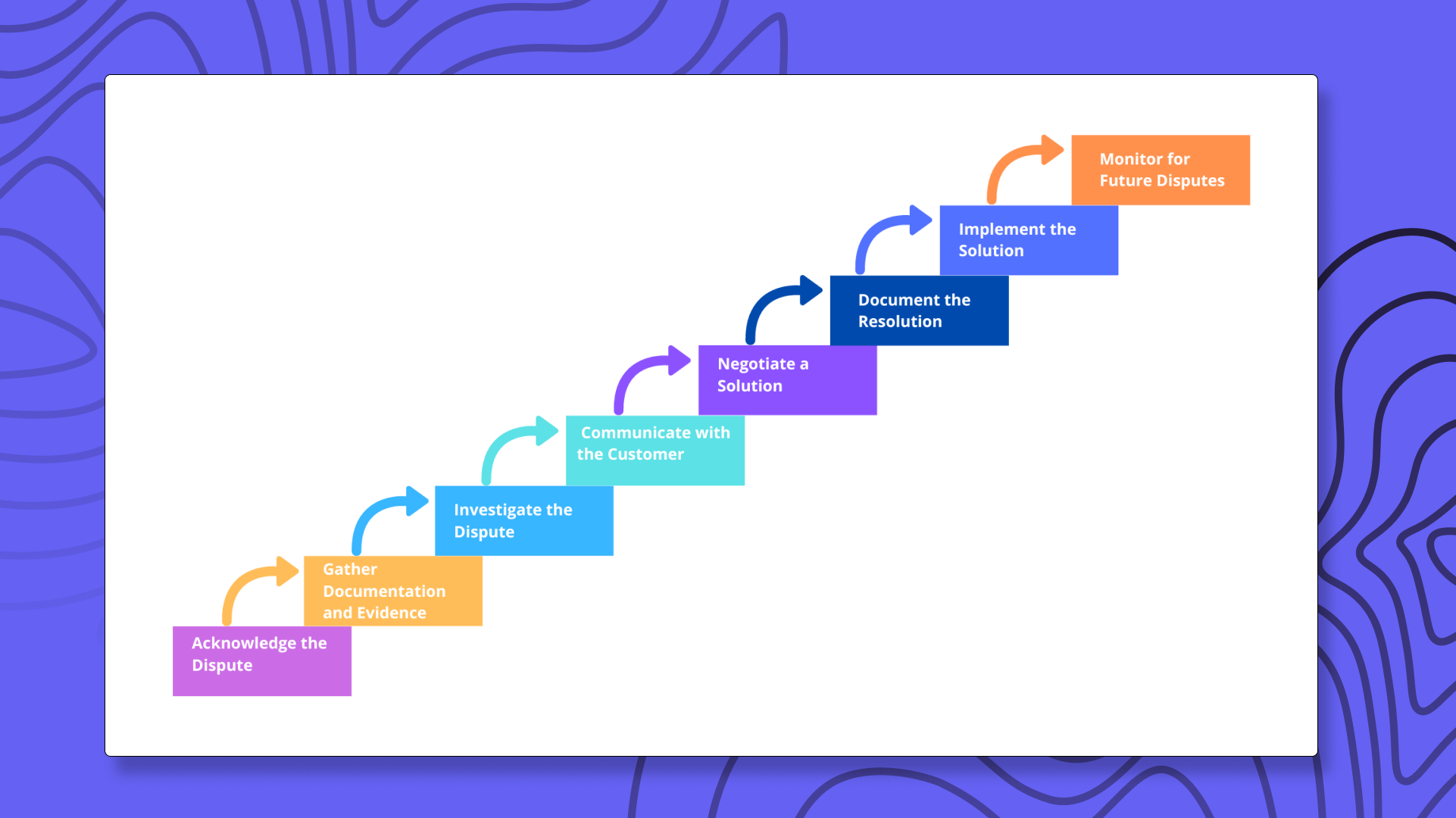

8 Steps to Handle Disputes With Ease

Handling disputes in collections and accounts receivable requires a structured and methodical approach to resolve issues quickly and maintain positive customer relationships. Here’s a step-by-step guide to effectively managing disputes:

1. Acknowledge the Dispute

The first step is to promptly acknowledge the customer's dispute. Whether the complaint comes through email, phone, or other channels, ensure you respond quickly, confirming that you are aware of the issue and are investigating it. This acknowledgment shows the customer that their concern is being taken seriously.

2. Gather Documentation and Evidence

Collect all relevant documentation, including invoices, contracts, order confirmations, delivery receipts, and communication records. This step is crucial for understanding the root cause of the dispute and ensuring you have the necessary information to resolve it. Thorough documentation helps clarify any misunderstandings and supports your case if the dispute escalates.

3. Investigate the Dispute

After gathering the necessary documents, conduct a thorough investigation. This may involve reviewing the customer’s account history, checking whether there are errors in billing, delivery, or quality of service, and confirming the terms of the agreement. Ensure you involve relevant departments, such as sales or shipping, if the dispute relates to product or service quality.

4. Communicate with the Customer

Once you've completed your investigation, communicate your findings to the customer. Be clear and transparent, providing them with all the relevant details. If the customer’s claim is valid, offer an appropriate solution, such as correcting the invoice, offering a discount, or replacing a faulty product. If the dispute is unfounded, explain your position respectfully and provide evidence to support your conclusion.

5. Negotiate a Solution

If the customer disagrees with your findings or the proposed resolution, enter into a negotiation. This is often necessary in disputes involving complex issues or large sums of money. Be open to compromises, such as payment plans, partial credits, or future service adjustments, to reach an amicable solution.

6. Document the Resolution

Once an agreement is reached, ensure that both parties clearly understand the terms of the resolution. Document the agreement in writing, whether through an email confirmation or a formal letter, so that there is no ambiguity. This record will be important in case of future disputes or misunderstandings.

7. Implement the Solution

Follow through with the resolution promptly. If the dispute involves crediting an account, issuing a refund, or delivering a new product, ensure that these actions are completed as agreed. Keeping the customer updated on the progress helps maintain trust and prevents further escalation.

8. Monitor for Future Disputes

After resolving the dispute, monitor the customer’s account to prevent future issues. Look for recurring patterns in disputes or complaints and take steps to address the root causes to avoid future disputes.

Top 7 Strategies for Dispute Management

Effective dispute management requires a proactive approach that goes beyond resolving individual cases. By implementing the following strategies, businesses can reduce the frequency of disputes and manage them more efficiently when they arise:

1. Establish Clear Contract Terms

One of the best ways to prevent disputes is to have clear, detailed contracts with customers. Ensure that payment terms, product or service specifications, and penalties for late payments are explicitly stated. This reduces the chances of misunderstandings later and provides a solid foundation for resolving disputes if they arise.

2. Implement Automated Invoice Systems

Using automated invoicing systems can help minimize human error, a common cause of disputes. Automated systems ensure that invoices are accurate, sent on time, and match the agreed-upon terms. They also provide a detailed record of every transaction, which can be useful in dispute resolution.

3. Provide Regular Account Reviews

Conducting regular account reviews with clients helps catch potential issues early. By going over invoices, payment schedules, and account statuses periodically, you can identify and address problems before they escalate into disputes. This proactive communication strengthens customer relationships.

4. Train Customer Service Teams in Conflict Resolution

Training customer service teams to handle disputes with empathy and professionalism can significantly improve outcomes. Equip them with techniques for de-escalating tense situations, active listening, and understanding the customer's perspective. Well-trained teams can often resolve disputes quickly, reducing the need to escalate.

5. Maintain Open Lines of Communication

Consistent, open communication with customers helps prevent disputes. Encourage customers to reach out whenever they have concerns, and make it easy for them to communicate. Regular check-ins or surveys can also help identify any dissatisfaction early, before it turns into a dispute.

6. Create a Centralized Dispute Management Process

Centralizing dispute management ensures that all disputes are handled consistently. This could involve creating a dedicated team or software that tracks disputes from start to finish, ensuring that nothing falls through the cracks. A streamlined process improves resolution times and reduces confusion.

7. Leverage Technology for Dispute Tracking

Using specialized dispute resolution software helps track disputes more effectively. Such tools can flag recurring issues, store communication records, and provide reminders for follow-ups, enabling faster resolution and better customer service.

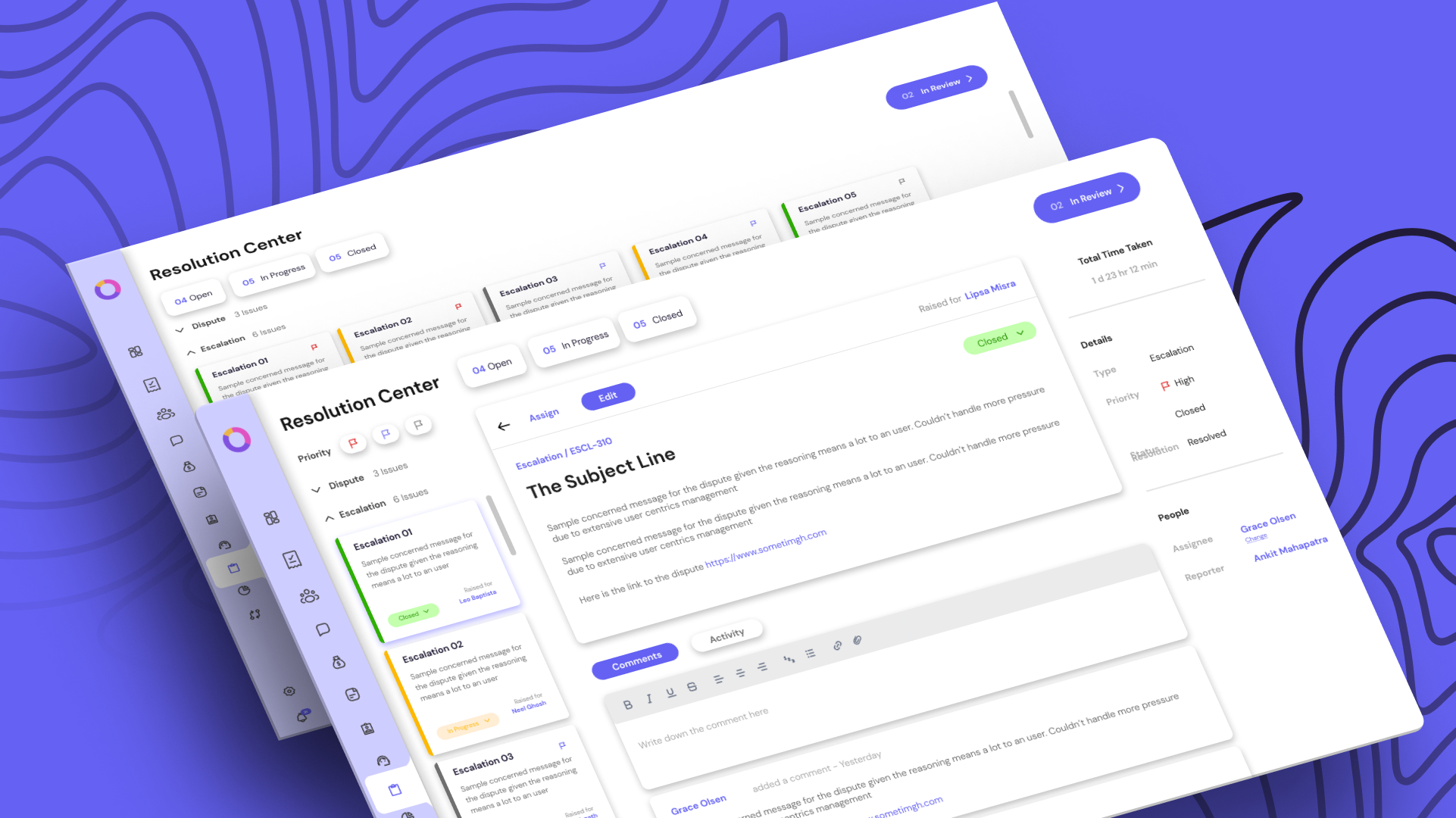

How Can FinanceOps Help You in Dispute Management?

FinanceOps offers a powerful solution for dispute management through its comprehensive resolution center, designed to streamline the process of handling and resolving disputes efficiently. Our platform automates key aspects of dispute management, allowing businesses to address issues quickly and maintain positive relationships with customers.

The resolution center centralizes dispute tracking, providing a clear overview of all open cases, escalations, manual interventions, and more. This helps teams collaborate more effectively, ensuring that disputes are managed consistently and transparently.

With FinanceOps, businesses can also set up automated workflows for dispute resolution, ensuring timely responses and follow-ups. This proactive approach prevents disputes from escalating and helps businesses resolve issues more quickly, leading to improved customer satisfaction and better cash flow.