FinanceOps vs Traditional Collection Methods: Everything You Need to Know

Despite technological advances across departments, many businesses still rely heavily on traditional, manual approaches to debt collection. This reliance creates inefficiencies, with reports showing that, on average, companies spend up to 30% of their operational time managing overdue accounts.

The manual approach isn't just time-consuming; it's expensive, too. According to industry standards, the average collection cost on past-due accounts can increase by as much as 50% when done manually. This erodes profitability while stretching already tight budgets, especially for businesses that rely on a steady cash flow to maintain operations.

Such inefficiencies of traditional methods can result in a negative financial impact, especially for companies experiencing growth or expansion. In this blog, we will take a quick look at the importance of efficient collections for businesses and how FinanceOps can help you achieve that goal.

The Need For Efficient Collections For Businesses

Research shows that 60% of small businesses face cash flow problems due to unpaid invoices, highlighting the importance of efficient collections to stabilize finances. However, most businesses still rely on traditional manual methods, often leading to inefficiencies and higher operational costs.

The time spent manually following up on overdue accounts, sending reminders, and managing records can significantly drain time and money that could have been used elsewhere. Here are five benefits of efficient collection processes that address modern business needs and are essential for navigating today’s challenges:

- Enhanced data-driven insights: Automation provides real-time data analytics, helping businesses identify trends and optimize follow-up strategies. This leads to improved financial forecasting and targeted interventions.

- Proactive risk management: Early flags for high-risk accounts allow businesses to engage customers before payment deadlines. This proactive approach helps minimize delinquencies and protects cash flow.

- Reduced psychological stress for collection teams: Automation alleviates the burden of repetitive tasks, enabling agents to focus on complex cases. This shift promotes empathy in client interactions and reduces burnout.

- Strengthened regulatory compliance: Automated processes create detailed logs of communications, ensuring organizations meet stringent compliance requirements. This reduces legal risks and helps maintain adherence to regulations.

- Improved brand reputation: Empathetic collection processes foster goodwill by treating customers fairly. A customer-centric approach enhances brand differentiation, leading to higher retention rates and positive word-of-mouth.

FinanceOps Vs. Traditional Collection Methods

Let’s take a look at the primary differences between FinanceOps and the manual collection processes used by most businesses.

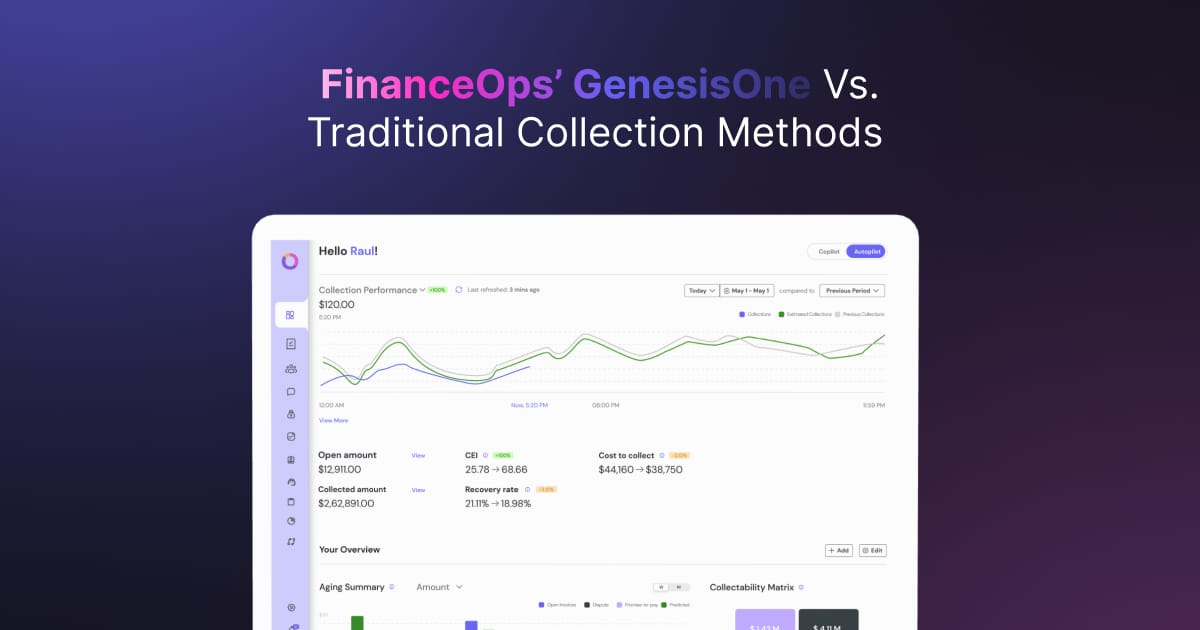

The Financial Impact of Switching to FinanceOps

Switching to FinanceOps provides businesses with substantial financial benefits by streamlining collections, cutting costs, and enhancing cash flow. Through automation, FinanceOps minimizes manual effort and collection expenses while reducing bad debt and improving ROI.

This scalable solution transforms collections into a revenue-boosting function, making it a strategic financial asset for sustainable growth. Let’s take a look at the financial impact we have created in multiple industries.

Healthcare

- 78.41% recovery of the total assigned outstanding balances

- Less than 0.01% dispute rate

- 60% CEI while collecting from 60 days past due accounts

- 80% reduction in operational costs

- 100% regulatory adherence

Download the complete case study here.

Financial Services

- 12.3% of the total outstanding of $4.15 million, which was due in the past 500 days

- 25% response rate from debtors who weren’t contacted for at least 6 months

- More than 400% ROI with an investment of $102,000 and a total recovery of $510,751

Download the complete case study here.

Final Thoughts

The shift from traditional methods to FinanceOps allows companies to streamline operations, improve cash flow, and enhance customer relationships. By reducing costs and increasing recovery rates, Genesis One turns collections into a strategic asset, positioning businesses for long-term growth and stability.

Embracing automation improves financial performance and aligns with evolving customer expectations for timely, personalized, and empathetic interactions. For companies aiming to thrive, adopting a smarter, more efficient approach to collections is a valuable investment. Get started today!