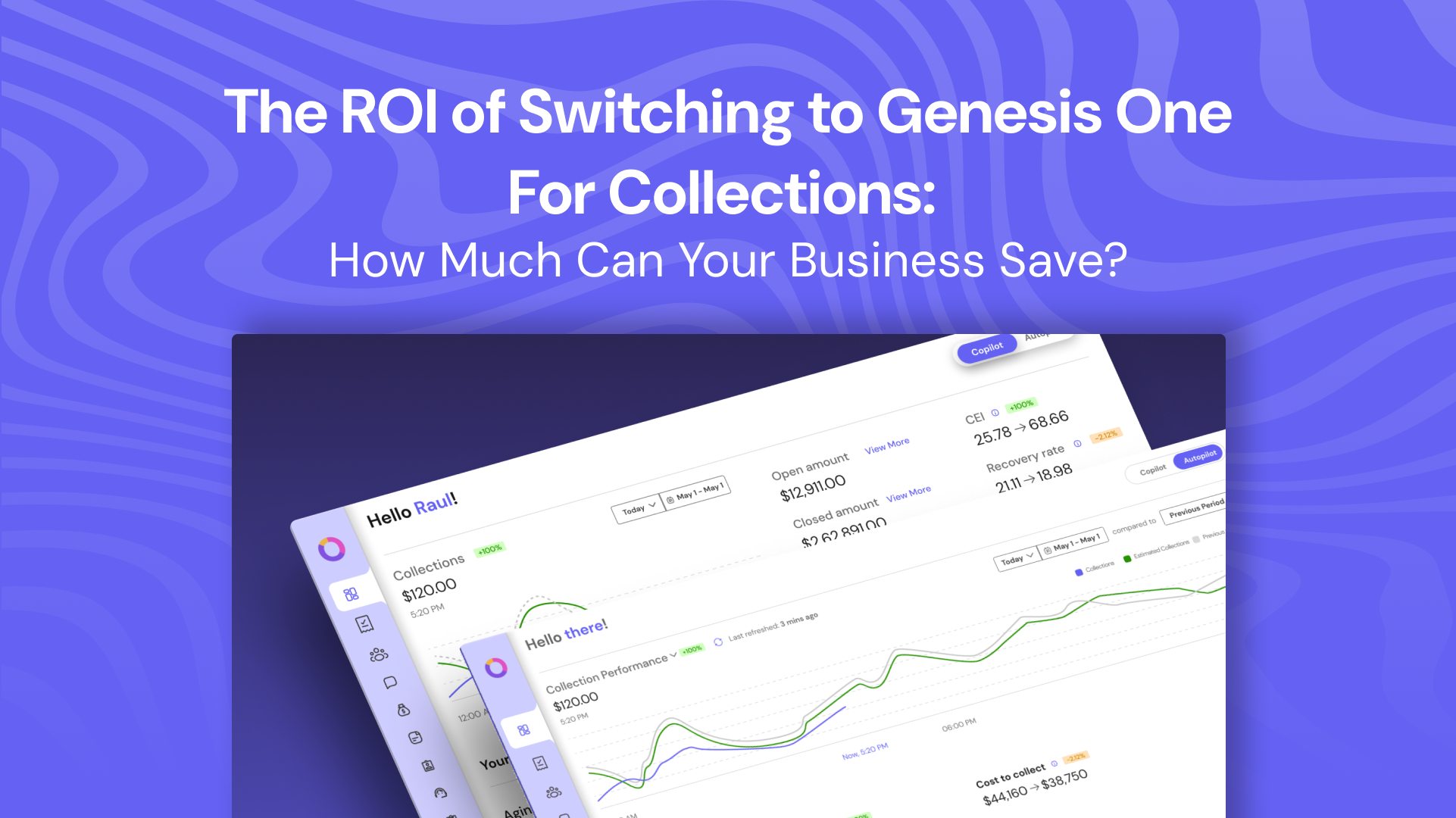

The ROI of Switching to Genesis One For Collections: How Much Can Your Business Save?

Depending on the size and complexity of your operations, businesses can save anywhere from $500,000 to $1,000,000 or more annually by switching to Genesis One, which is at least a 6-10x return on investment.

When it comes to investing in a new solution or platform, return on investment (ROI) is a crucial metric that every business considers. No matter how good a platform is, if it doesn’t help you cut down costs or increase revenue, its not worth investing in.

That’s why we are here to talk about straight-up numbers and why you should switch to Genesis One.

Being the world’s first fully autonomous financial operations platform, Genesis One promises a significant boost in efficiency and cost savings. But how much can your business actually save by switching to our platform? Let’s dive into its key benefits and how they translate into real monetary savings.

Understanding the Value of Automation

Genesis One streamlines and automates back-office financial operations, from accounts receivable management to financial reporting. It reduces manual intervention, minimizes errors, and increases the speed of operations. But why does this matter?

1. Labor cost savings

Automation of repetitive tasks eliminates the need for manual data entry, follow-ups on overdue payments, and tedious financial reporting. It allows teams to spend less time on these tasks and more time on value-added activities.

According to a study by Mckinsey, automating tasks can reduce labor costs by up to 30% in certain departments. Let’s say your business has a finance team of 10 people, with each employee earning an average of $60,000 per year. If automation allows each team member to save just 30% of their time, reducing dependency on manpower, that’s $180,000 annually in labor cost savings.

2. Error reduction

Even a small mistake made in invoicing, collections, or data entry can result in delayed payments, financial penalties, and even damage to client relationships. According to a report, the average employee makes 118 mistakes a year, and the US loses around $3.1 trillion a year just due to such errors.

With AI-driven automation, Genesis One significantly reduces the risk of these errors. For a company with annual revenues of $20 million, this could mean savings of $200,000 to $400,000 (1-2%) by preventing errors through automation.

3. Speeding up collections

One of the standout features of Genesis One is its AI-powered collections agent, Alice. She can analyze customer behavior, predict payment likelihoods, and engage in real-time conversations with customers to negotiate payment terms. Alice also takes an empathetic approach to collections, which significantly increases the likelihood of payments.

By speeding up collections and improving cash flow, businesses can avoid the cost of payment delays and reduce their days sales outstanding (DSO). Reducing the DSO by even 10 days can have a dramatic impact on a company's cash flow, which can be particularly beneficial for small to midsized enterprises.

4. Improved financial reporting and insights

Traditional financial reporting processes can be cumbersome, often requiring manual data compilation from various sources. With Genesis One, this process is automated and streamlined, providing more accurate reports faster.

It translates to better decision-making and allows businesses to identify issues early, make proactive financial decisions, and adjust strategies before problems escalate. Furthermore, the platform’s advanced risk management features help companies avoid costly financial mistakes.

Over time, the ability to act on real-time data can save businesses substantial amounts of money, preventing potential losses tied to poor financial forecasting or missed growth opportunities.

The Long-Term Benefits of Scalability

One often overlooked factor when evaluating ROI is the long-term scalability of a solution. Genesis One is designed to grow with your business, whether you’re a small business or a large enterprise.

As your business expands, the platform adapts to accommodate increased financial complexity, higher transaction volumes and accounts, and more sophisticated reporting needs—all without requiring additional staffing or resources.

This scalability means that as your business grows, your operational costs don’t increase at the same rate. Instead of hiring more employees to manage an expanding workload, you can rely on Genesis One to handle the increased volume through automation, saving hundreds of thousands of dollars over the long term.

The Financial Impact of Genesis One

The ROI of switching to Genesis One is clear. From labor cost savings and error reduction to improved collections and financial reporting, Genesis One delivers measurable financial benefits.

Depending on the size and complexity of your operations, businesses can save anywhere from $500,000 to $1,000,000 or more annually by switching to Genesis One, which is at least a 6-10x return on investment.

For companies looking to improve efficiency, reduce costs, and future-proof their financial operations, the decision to adopt Genesis One is an investment that pays for itself many times over.

Get in touch with us to dive deeper into the cost-benefit analysis of Genesis One.