What Are Delinquent Accounts: Strategies That Will Help You Take Control

Imagine a small business that sells handcrafted furniture. Initially, everything seems to be going well, with customers eagerly purchasing products on credit. However, as the months go by, many of these customers start missing payments. What was once a thriving cash flow begins to dwindle, leading to cash shortages that threaten the business's sustainability.

This situation is a classic example of delinquent accounts—accounts that are overdue on payments and pose a risk to the financial health of any business. In fact, according to Attradius, nearly 55% of all loans in the United States are overdue, indicating that the issue of unpaid debts is widespread.

Delinquent accounts can impact your bottom line, hinder growth, and create cash flow challenges. However, with the right strategies, businesses can regain control of their receivables and improve their financial situation. In this blog, we will explore effective strategies to manage delinquent accounts and ensure a healthier financial future for your business.

What Are Delinquent Accounts?

Delinquent accounts refer to any outstanding debts that have not been paid by the borrower within the specified payment period. These accounts can arise in various contexts, such as credit cards, loans, or invoices from service providers. A delinquent account typically indicates that the borrower has missed at least one payment, signaling potential financial distress or negligence.

When accounts become delinquent, they can lead to several consequences for both the creditor and the borrower. Creditors may face cash flow issues, which can hinder their ability to operate effectively. For borrowers, delinquent accounts can damage credit scores, making it challenging to secure future loans or credit. The severity of delinquency can escalate; accounts may move from being merely late to becoming charge-offs or sent to collections if not addressed promptly.

It’s crucial for businesses and individuals to monitor their accounts and take proactive steps to manage delinquency. Effective communication, flexible payment options, and a robust collections strategy can help reduce the number of delinquent accounts, ensuring financial stability and protecting creditworthiness. Understanding the implications of delinquent accounts is the first step toward regaining control over one’s financial situation.

Key Examples of Delinquent Accounts

Here are some common examples of delinquent accounts:

- Credit card accounts: When cardholders fail to make their minimum payments by the due date, their credit card accounts become delinquent.

- Personal loans: Individuals who take out personal loans and miss their scheduled payments can fall into delinquency.

- Utility accounts: Customers who do not pay their utility bills (such as electricity, gas, or water) on time may mark their accounts as delinquent.

- Rental agreements: Tenants who fail to pay their rent by the agreed-upon date can be considered delinquent.

- Business invoices: Companies that provide goods or services on credit may experience delinquent accounts when their clients do not pay invoices by the due date.

Top 5 Drivers Behind Payment Delinquencies (And How to Address Them)

Understanding the root causes of payment delinquencies can help businesses devise effective strategies to mitigate risks and maintain healthy cash flow. By addressing these underlying issues, companies can not only recover payments but also strengthen customer relationships. Here are five key drivers of payment delinquencies, along with unique approaches to tackle them.

1. Unexpected life events

Sudden life changes, such as job loss or health crises, can derail even the most responsible customers. To support them, businesses could implement an emergency relief program, offering temporary financial assistance or deferred payment options. This gesture can enhance customer loyalty while allowing them to regain stability.

2. Insufficient payment notifications

Customers may overlook payment deadlines, especially if they aren't reminded in a timely manner. To combat this, consider creating a multi-channel notification system that sends alerts via app notifications, social media messages, and personalized emails. Engaging customers where they are most active can help keep their obligations front of mind.

3. User-friendly payment solutions

If the payment process feels cumbersome or outdated, customers might hesitate to complete transactions. Investing in user-friendly technology that streamlines payments—such as mobile payment apps or one-click payment options—can significantly enhance the customer experience, encouraging prompt payments.

4. Market volatility

Fluctuating economic conditions can squeeze household budgets, making it difficult for customers to manage their financial commitments. Businesses could consider introducing loyalty programs or offering temporary discounts during challenging economic periods, demonstrating understanding and support for their customers' situations.

5. Education gaps in financial management

A lack of financial literacy can lead customers to mismanage their debts. Businesses can step in by hosting workshops or providing online resources that teach effective budgeting and debt management strategies. By empowering customers with knowledge, companies can foster more responsible financial behaviors, ultimately reducing delinquencies.

The Impact of Delinquent Accounts on Businesses

Delinquent accounts can significantly impact businesses, creating challenges that extend far beyond missed payments. These overdue debts disrupt cash flow, strain customer relationships, and can even threaten the overall financial health of a company. Understanding the various implications of delinquent accounts is crucial for businesses to develop effective strategies to manage them and maintain stability in their operations.

- Cash flow disruption: Delinquent accounts can severely disrupt cash flow, which is vital for day-to-day operations. According to a study by the National Federation of Independent Businesses, about 82% of small businesses fail due to cash flow mismanagement, highlighting the importance of timely payments.

- Increased collection costs: Recovering payments from delinquent accounts often incur additional costs, including collection agency fees and legal expenses. These unexpected expenses can negatively affect a business’s profitability.

- Impact on creditworthiness: High delinquent accounts can negatively affect a business’s credit score, making it challenging to secure loans or favorable credit terms in the future. This can limit growth potential and hinder financial stability.

- Reduced profit margins: Delinquent accounts can lead to significant losses, impacting overall profitability. Bad debts can accumulate and affect the bottom line, making it harder for businesses to maintain healthy profit margins.

- Resource allocation issues: Managing delinquent accounts diverts time and resources from core business activities. Employees May spend excessive time on collections instead of focusing on strategic initiatives that drive growth.

- Damage to customer relationships: Frequent reminders and collections efforts can strain customer relationships, leading to dissatisfaction and potential loss of future business. A negative experience in collections can drive customers away.

- Negative impact on reputation: Delinquency can tarnish a company’s reputation, making it less attractive to new customers and partners. A poor reputation regarding payment practices can deter potential clients.

- Difficulty in forecasting revenues: Delinquent accounts create uncertainty in revenue forecasting, complicating financial planning and budgeting. This unpredictability can hinder a business’s ability to make informed decisions.

- Increased risk of bankruptcy: Chronic delinquency can lead to severe financial distress and, ultimately, bankruptcy. Unmanaged debt levels can overwhelm businesses, leading to a loss of viability.

- Opportunity cost: Delinquent accounts represent lost opportunities for growth and investment. Funds in unpaid invoices could be used for essential operations or expansion initiatives, limiting a business’s potential.

7 Proven Strategies to Effectively Manage Delinquent Accounts

Managing delinquent accounts is essential for maintaining financial health and ensuring business sustainability. Implementing proactive strategies can help businesses recover unpaid debts while preserving customer relationships. Here are seven proven strategies to effectively manage delinquent accounts:

1. Regular communication

Maintain consistent communication with customers about their account status. Sending friendly reminders a few days before payment is due can help keep obligations top of mind. Additionally, follow up promptly if a payment is missed, as early intervention can often resolve issues before they escalate.

2. Flexible payment options

Offering flexible payment options can make it easier for customers to meet their obligations. Consider implementing installment plans, accepting various payment methods, or allowing customers to choose their payment schedule. Flexibility can enhance customer satisfaction and increase the likelihood of prompt payments.

3. Early intervention

Address delinquent accounts quickly to prevent them from becoming chronic issues. Reach out to customers as soon as a payment is missed and inquire about any difficulties they may be facing. Early intervention demonstrates your willingness to work with them and can lead to quicker resolutions.

4. Incentives for timely payments

Consider implementing incentives for customers who pay their invoices promptly. Offering discounts for early payments or loyalty rewards can motivate customers to prioritize their accounts. These incentives can create a win-win situation, enhancing customer relationships while improving cash flow.

5. Utilize personal touch

Personalizing communication with customers can create a more positive interaction. When reaching out about overdue accounts, use their names and reference their specific situations. A personal touch and some empathy can foster goodwill and increase the chances of timely payments.

6. Segment your accounts

Categorize delinquent accounts based on the level of delinquency and customer behavior. By segmenting accounts, you can tailor your approach to collections, using more aggressive tactics for high-risk accounts while maintaining a softer approach for long-standing customers facing temporary difficulties.

7. Review and adjust credit limits

Regularly review customer credit limits based on their payment history and overall financial behavior. Adjusting credit limits for customers who consistently miss payments can help reduce the risk of future delinquencies. This proactive approach ensures that you are not extending credit to those who cannot manage it responsibly.

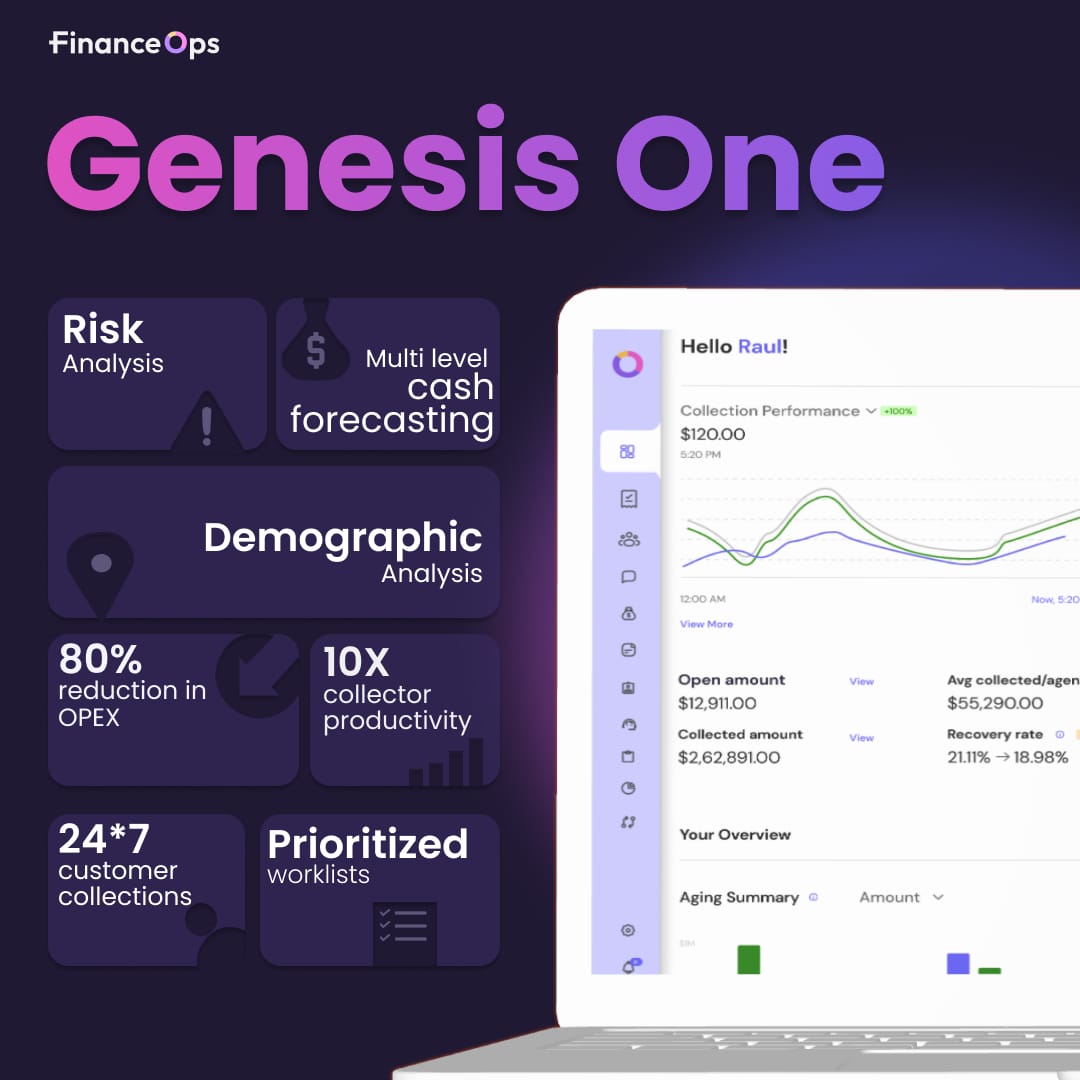

Reduce Delinquency and Improve Your Collections with Financeops

Managing delinquent accounts can be daunting for any business, but FinanceOps is here to streamline this process. Our platform leverages advanced automation and AI-driven tools to help companies reduce delinquency rates and improve their collections.

By automating routine tasks such as payment reminders and follow-ups, FinanceOps ensures that your team can focus on higher-value activities while maintaining consistent customer communication. Our intelligent collection strategies allow businesses to tailor their approach based on individual customer behavior and payment history.

With FinanceOps, you can set up personalized payment plans that meet each customer's unique needs, fostering goodwill and encouraging timely payments. Additionally, our robust analytics provide insights into delinquent accounts, enabling you to identify trends and implement proactive measures before accounts become severely overdue.

FinanceOps also enhances the customer experience by offering flexible payment options and clear, empathetic communication regarding outstanding balances. By simplifying the payment process and providing support, you can strengthen customer relationships while ensuring your cash flow is healthy.

Get on a call with us today to transform your collections strategy, reduce delinquency, and secure a more stable financial future for your business.